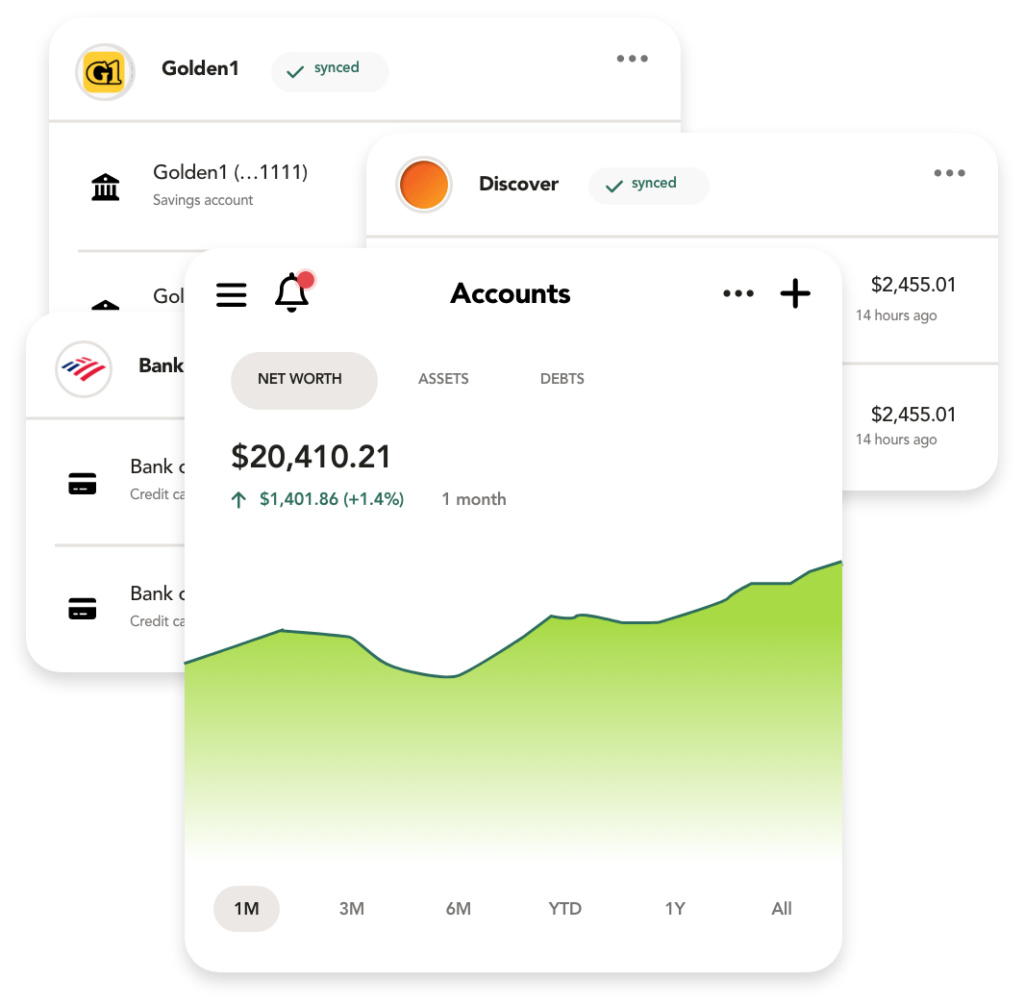

NET WORTH

One place for all your accounts

Connect your bank accounts, credit cards, and investments to see your entire financial picture. Sync your partner’s accounts to get a shared view of your finances.

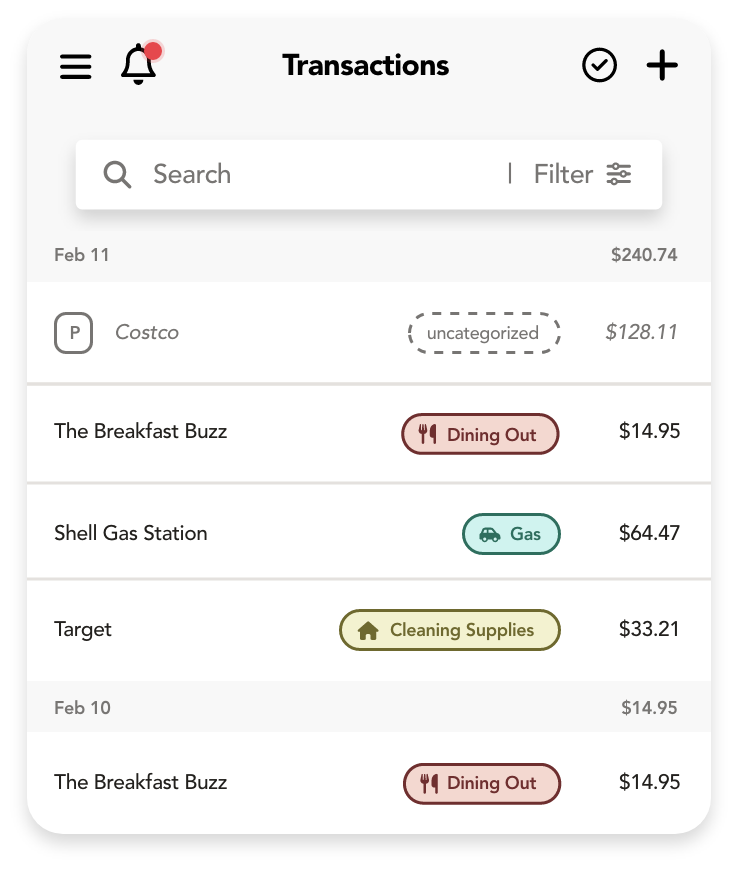

TRANSACTIONS

Your transactions in one list

Stop jumping between apps or bank websites. WizeFi brings all your transactions into one clean list. You can also mark transactions as reviewed to stay on top of unexpected spending.

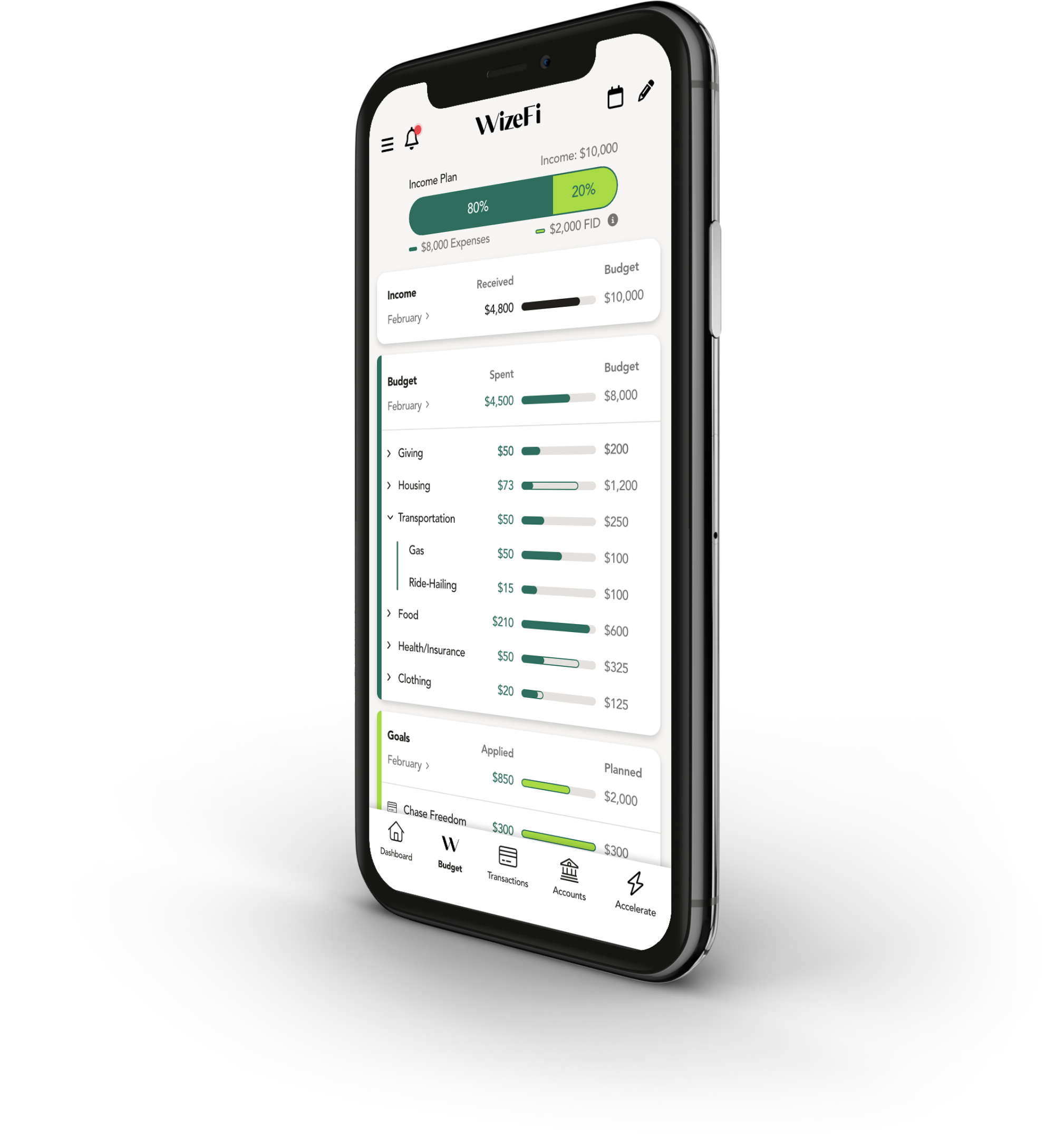

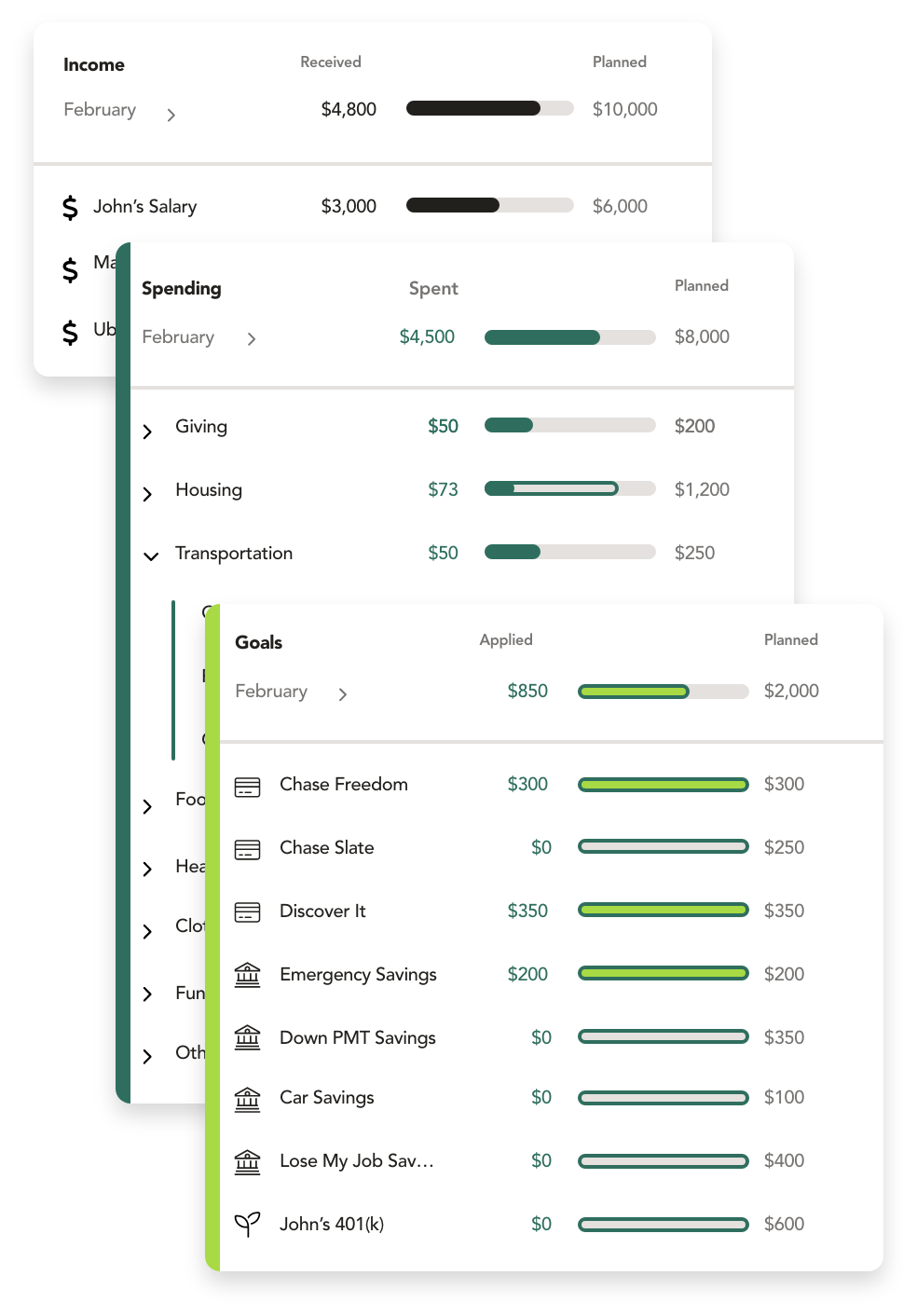

BUDGET

Tell your money where to go

Most apps just track the past. WizeFi plans your future. Create a flexible, zero-based strategy that gives every dollar a job and adapts instantly to real life. Stop guessing and start building wealth.

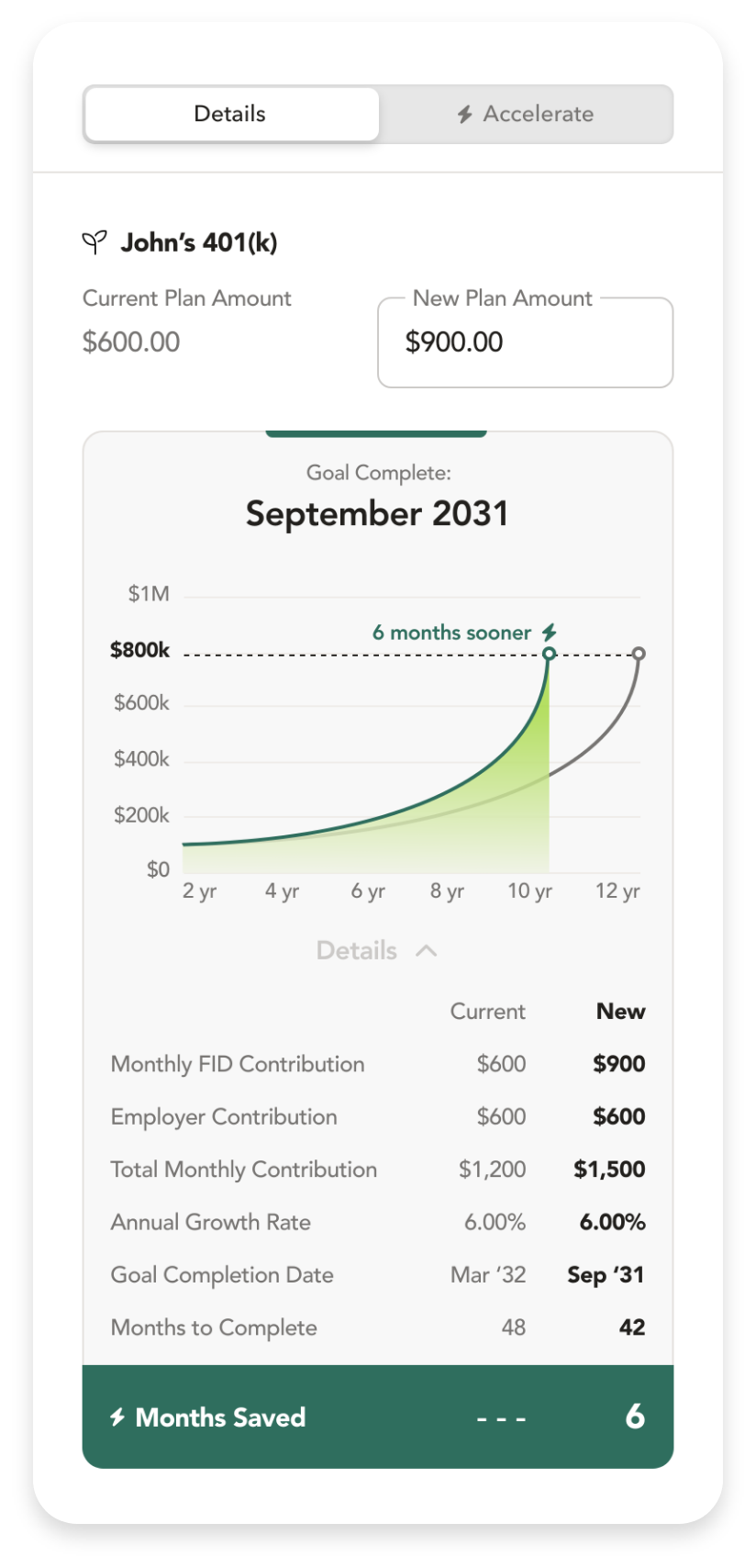

GOALS

Fast-track your freedom

Don't just set a target, engineer the path to hit it. WizeFi’s Goal Accelerator uses machine learning to find hidden opportunities in your budget, instantly showing you how small tweaks today can shave months (or years) off your timeline.

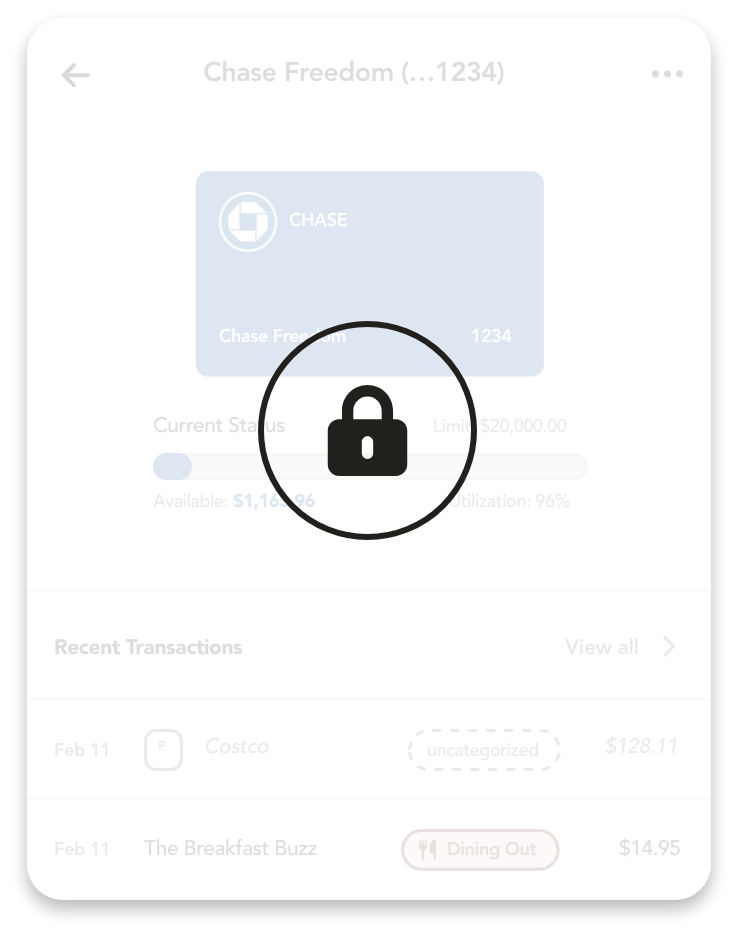

PRIVATE & SECURE

Bank Level Security

We use bank-grade 256-bit encryption with multiple data providers to sync with 13,000+ institutions, but true security goes beyond technology. Unlike other free tools, we never sell your personal data to advertisers. Your finances are private, view-only, and 100% yours.

FAQs