Budget

Savings

Debt

Insurance

Investments

Is your budget effective?

The way we manage our money determines our wealth potential. At WizeFi, our goal for budgets is never just to help your money last through the month–it’s to put your money to work, ensuring that you’ll have more wealth next month than you did the one before.

We’ve compiled data from thousands of test cases to provide a guideline for the most effective budget.

When you sign up, our planner will provide this data for six more spending categories as well as information on how much you should spend.

Adjust the sliders to see if

your spending is on track

What is your monthly take-home pay?

It's the middle of summer;

your air conditioning goes out.

What do you do?

If you don’t have an effective savings plan,

you only have two choices: either sweat it out

until you can afford to fix it, or put the

balance on your credit card.

Lack of savings is one of the biggest reasons why

people have such a hard time getting out of debt.

WizeFi will help you build your savings accounts

so you have a third option: pay for it, stress free.

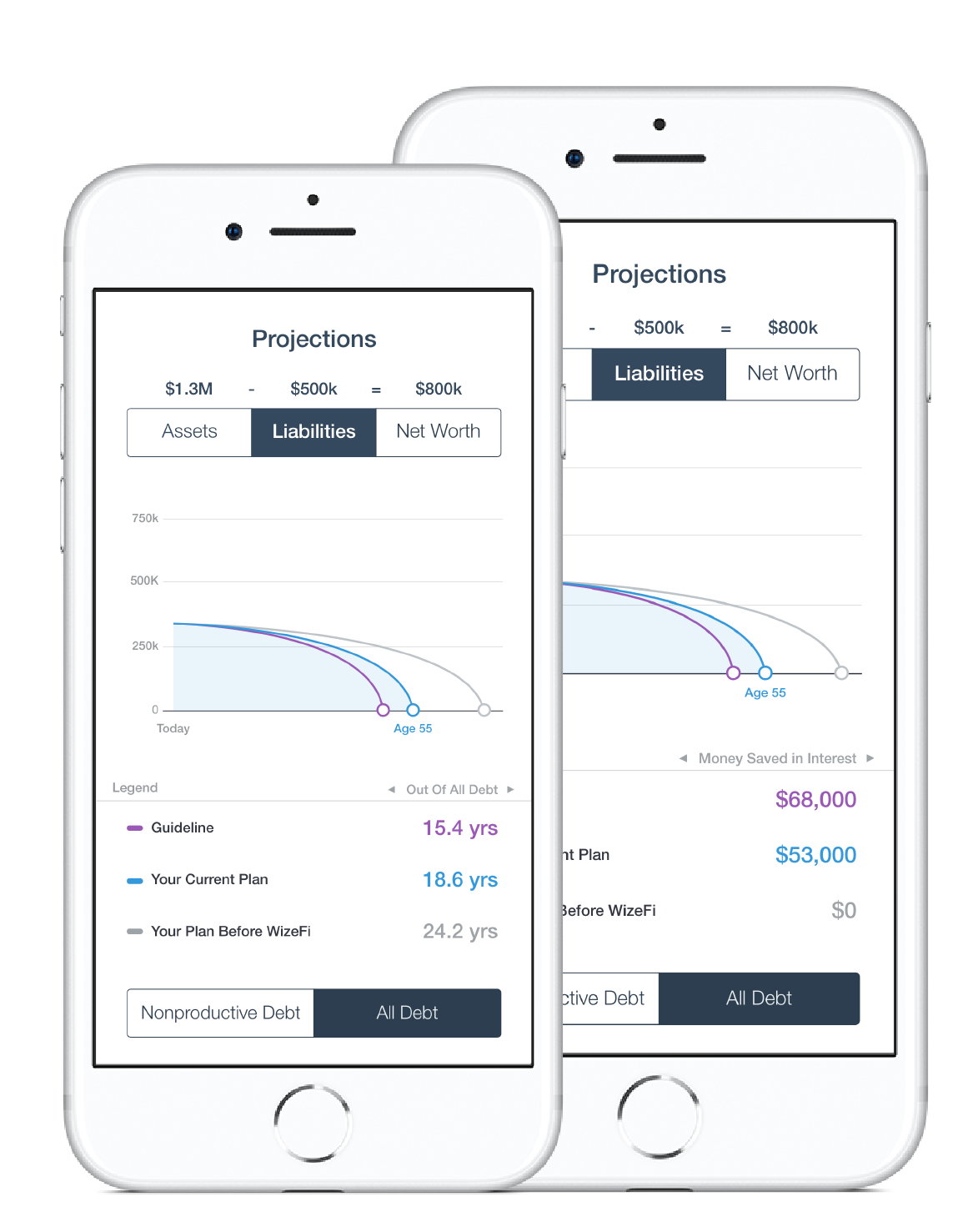

Get out of debt, faster.

The average American household carries $137,063

in debt. Fortunately, the average WizeFi member

gets out of debt 30% faster than the average

American by following a customized WizeFi plan.

If you’re paying more interest than you’re earning,

you’re probably not building wealth. WizeFi will

show you which debts to pay off first, how much

to pay on each debt, and how to add more cash

flow to get out of debt even faster.

Are you properly protected?

Everyone with a car has car insurance. Most people

with a home own home insurance. We know that doctor’s

visits will be a lot more affordable if we have health

insurance. But what are you really protecting?

Your most important asset is your ability to earn an

income. Without it, all wealth-building efforts

are compromised. WizeFi can help you get the insurance that's

right for you and can connect you with a professional. We want

to make sure you are well protected, as well as within the

budget of a wealth-building system.

Put your money to work.

The last step in your wealth-building plan is investing.

Do you know how much to invest, which investments

to make, or when to invest? WizeFi will help

you answer all of these questions.

Play with the slider to see what even a little

bit of investing can do for your net worth

over time.

See how consistent investing

builds your net worth.

Based on a % average growth rate per year.

10 years

20 years

40 years

WHAT CUSTOMERS SAY