Why Everyone Needs an Emergency Fund

When it rains, it pours.

Emergencies are an inevitable part of life. Whether it’s a car breaking down or an unexpected medical bill, emergencies happen to everyone. But–not nearly enough people are financially prepared to handle them.

Americans are unprepared for emergencies.

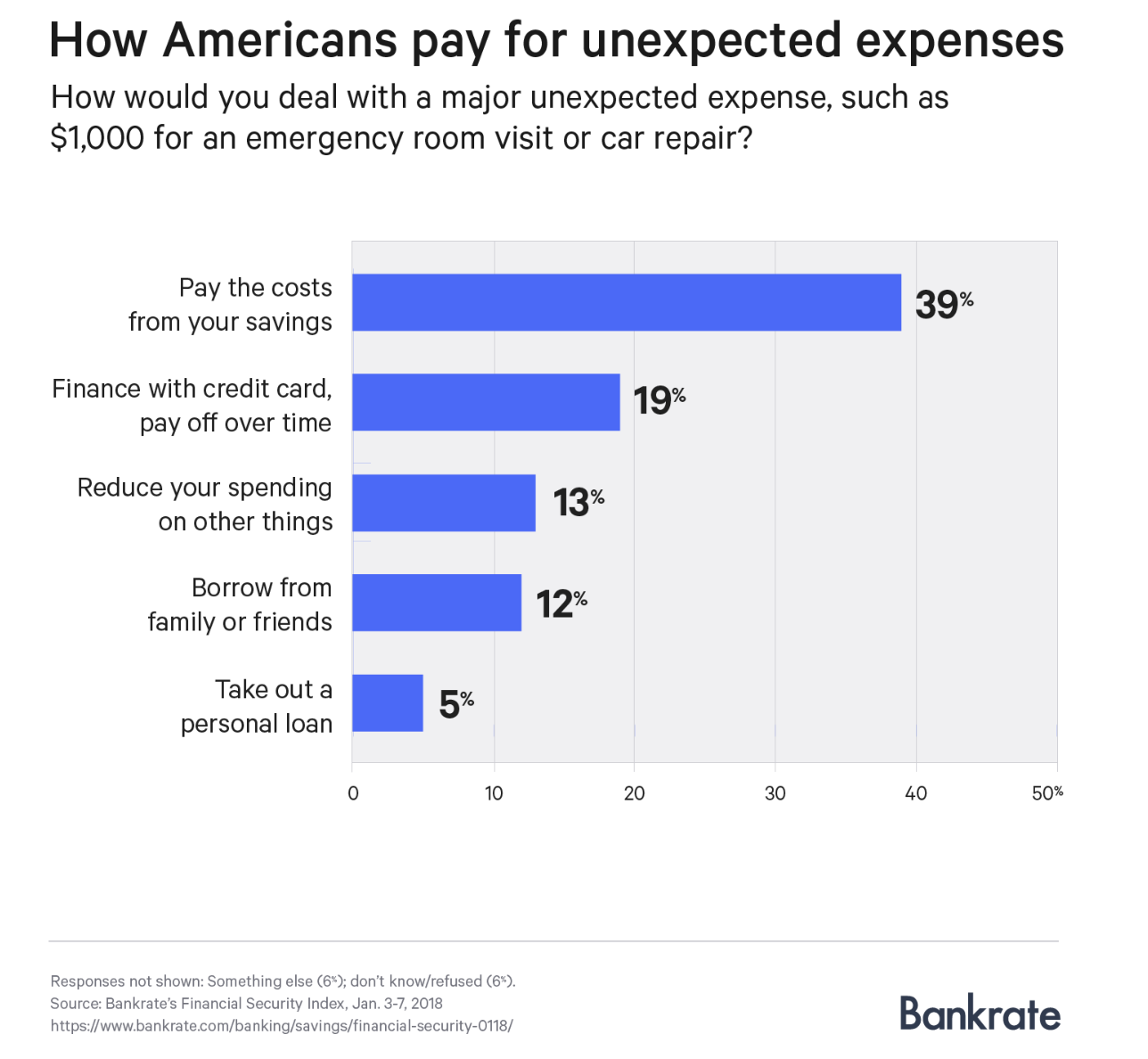

According to Bankrate’s latest financial security index survey, 34 percent of American households experienced a major unexpected expense over the past year. The shocker is, only 39% of respondents said that they would be able to cover a $1,000 setback with their savings.

This is concerning, as highlighted by one of Bankrate’s conclusions:

“More than a third of Americans would sink into one type of debt or another, potentially harming their financial security,” Bankrate says in the report.

The biggest repercussion, by far, of not having an emergency fund being forced to rely on racking up more debt in order to get out of the hole, so to speak.

Remember the recession?

The 2007-2009 recession was one of the worst in history, with almost one in ten Americans facing unemployment. Stock values plummeted, rates of foreclosure went through the roof, and way too many people felt the pain of financial stress.

Unfortunately, recessions are a natural part of economics. In order for economies to expand, they also have to contract. Usually, the effects of a contracting economy aren’t so dramatic, but the fact is that another recession will come–likely, soon.

By setting up a proper financial foundation, that is, building an emergency fund and getting yourself out of debt, you are helping to make yourself recession-proof. If you do lose your job or are forced to take a pay cut, your emergency fund will allow you to avoid financial consequences like debt dependency and bankruptcy.

WizeFi is here to help your emergency fund

Step 1 of the WizeFi plan advises that you set up an emergency fund and put at least one month’s worth of net income in it, up to $8,000. Emergency funds are there to cover immediate emergencies, like a hole in your roof or a hospital expense. Usually, one month’s worth of net income will anything like this.

Larger expenses like replacing your roof, air conditioning unit, or car would come from your general savings account–that’s Step 3 of WizeFi’s plan.

An emergency fund is your best line of defense when it comes to expenses. It’s important that it’s treated as such–meaning saving your emergency fund should come before paying off debt. At the end of the day, an emergency fund can keep an unexpected expense from bankrupting you.

WizeFi will help you deliberately put aside a portion of your paycheck towards your emergency fund every month. Once our software has analyzed your profile, it will tell you how much to spend on each budget category like food and entertainment, and it will also tell you how much to save each month.

We suggest that your emergency fund should be separate from your usual savings or checking account. This will make it easier to see exactly how much money you’ve saved and make your fund harder to spend on non-emergencies.

This way, you’re financially equipped for any calamity that may come your way and confident that you can weather it.

Photo by Genaro Servín from Pexels